Stamp duty refunds: Once we have confirmed the validity of your claim and we agree to work together, we will give you free access to our secure client portal. This platform will allow you to easily answer all relevant questions and upload any necessary documents. Some of the information we may need when making a stamp duty refund claim on your behalf.

—-

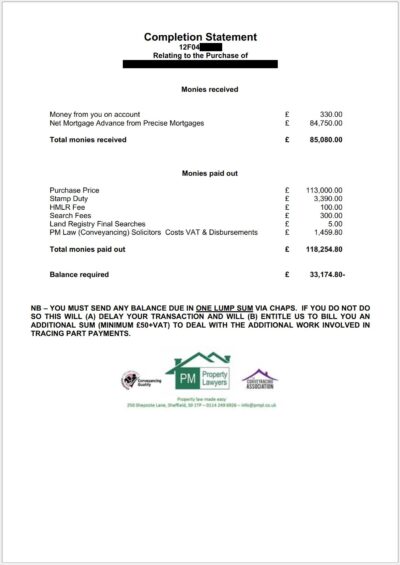

We need a copy of the completion statement issued to you by your solicitor for your property transaction.

A completion statement in property transactions is a document prepared by the conveyancer or solicitor that sets out all the financial details related to the purchase or sale of a property. It includes details of all the costs and fees associated with the transaction, such as the purchase price, stamp duty, legal fees, search fees, and any other expenses. The statement provides a breakdown of the amounts paid and received, and shows how any remaining funds will be dealt with. The completion statement is usually prepared in advance of the completion date and is used as a reference by the parties involved to ensure that all payments and costs are accounted for on the day of completion.