Several of our clients have entered into mortgage agreements with Gatehouse Bank, a lender that operates based on sharia finance principles.

If you’re seeking a stamp duty refund, you’ll need to provide:

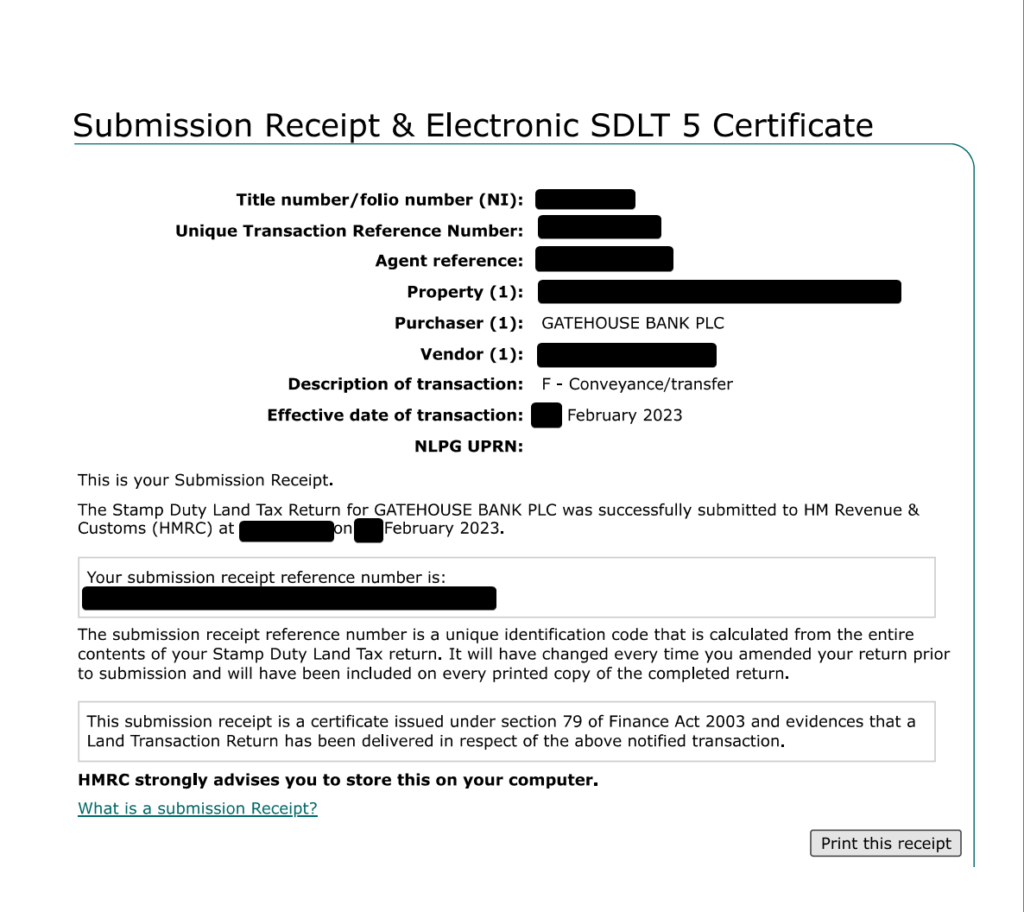

- Two copies of the SDLT5 Document. Gatehouse bank You can ask your conveyancing solicitor for these, or give us authorisation and we can ask on your behalf.

- A letter from Gatehouse Bank addressed to HMRC, authorizing them to repay any reclaimed funds back to you. You can contact Gatehouse bank directly, perhaps give them a link to this article. A copy of the necessary authorisation is shown below.

SDLT5

The SDLT5 Document, otherwise known as the Stamp Duty Land Tax Certificate, is a vital document issued by the HMRC (Her Majesty’s Revenue and Customs) in the United Kingdom. It serves as proof that the appropriate Stamp Duty Land Tax (SDLT) has been paid on a property transaction. This certificate is typically issued after the completion of the transaction, once the HMRC has processed the SDLT return and received the due stamp duty.

In the context of a transaction with Gatehouse Bank, two SDLT5 Documents are required for a stamp duty refund. This is because the transaction essentially happens in two parts due to the nature of Sharia-compliant finance. Firstly, Gatehouse Bank part purchases the property (for which stamp duty is paid and one SDLT5 Document is issued), and then, it leases the property back to you, the investor (for which another SDLT5 Document is issued).

Each of these stages is treated as a separate transaction from a tax perspective and, therefore, has its own SDLT5 Document. When applying for a stamp duty refund, you need to provide both SDLT5 Documents to demonstrate that all necessary taxes were paid during these two stages of the transaction. This evidence is crucial for the HMRC to process your refund request.

SDLT5 from seller to Gatehouse Bank, technically the purchaser.

SDLT5 from Gatehouse Bank to the leaseholder who will be the property ‘purchaser’ under sharia law

Example of the Gatehouse bank authorisation document.